CrossCountry Mortgage: Reviews and Ratings

Purchasing a home is a massive milestone in life. It’s something all Americans strive for and make serious plans around. The process of buying a home is a rigorous and sometimes stressful one, especially as mortgage rates continually increase year to year. It’s imperative to make the correct decision on the mortgage lender you choose when you’re ready for your forever home.

With so many options to turn to, and all of them offering slightly different packages, it’s hard to know if you’re being taken advantage of, or wasting your time. That’s where we come. We seek to give you important information to help you get your dream home as easily as possible.

Today, we’re gonna take a look at CrossCountry Mortgage, one of the nation’s leading retail mortgage lenders. No doubt their name has popped up if you’re doing research on mortgages. They are known for having a broad product lineup, fast approvals, and down payment assistance.

We’re gonna analyze them from all angles, including company history and overview, services, customer reviews, comparison to competitors, application process, among other aspects. By the end of this article, you’ll be an expert on all things pertaining to CrossCountry Mortgage, which’ll be invaluable in your journey to buying a home.

Remember, as with any financial decision, thorough and impartial research is extremely important to find the perfect complement for your financial goals. Read on to find out if CrossCountry Mortgage is the one for you! Grab a tasty beverage, get a cozy blanket, and get comfy as we dive right into it.

Overview and Services

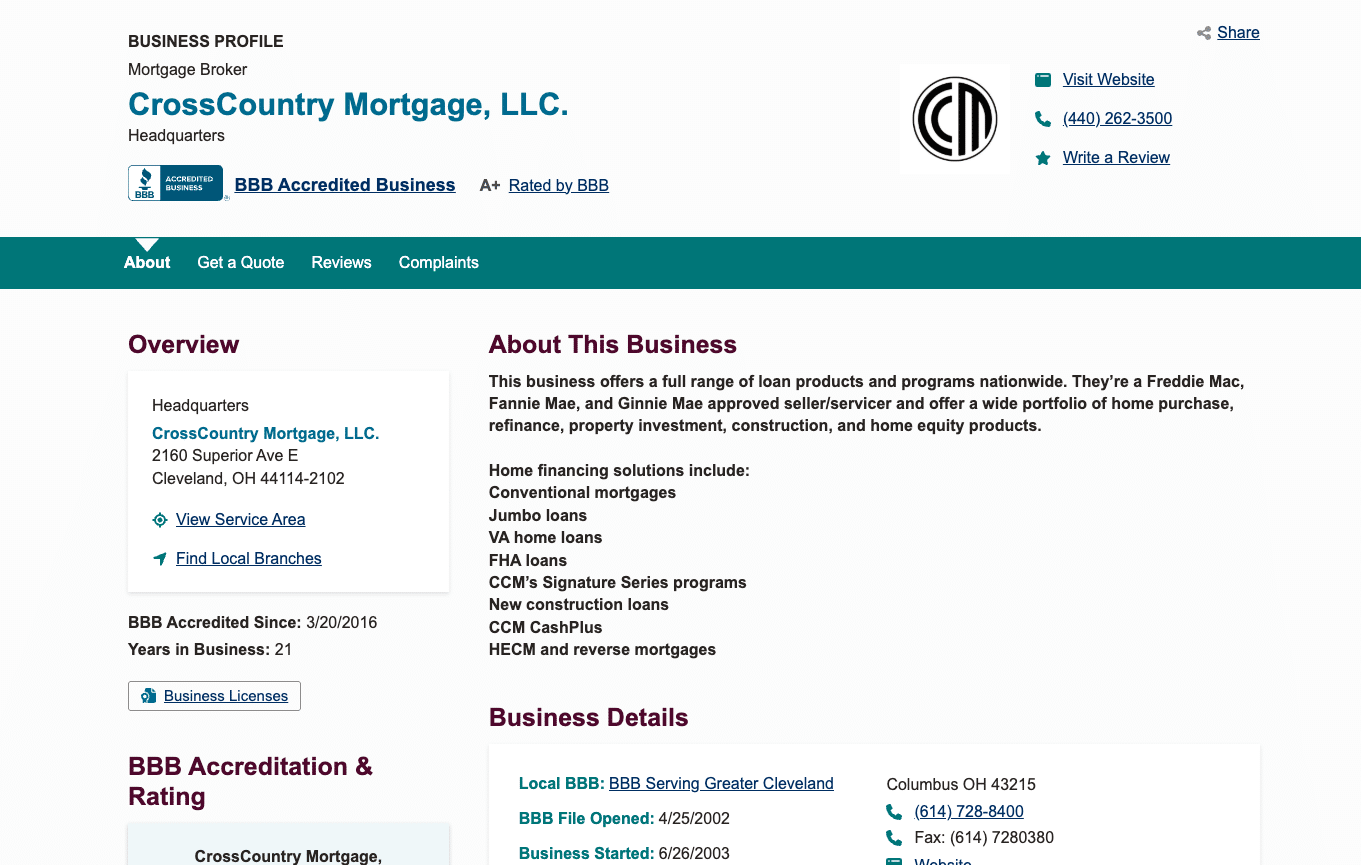

CrossCountry Mortgage was founded in 2003 by CEO Ron Leonhardt. The company has had an impressive expansion, going from a small regional lender to now being the nation’s largest retail mortgage lender. Not a bad 22-year run! They are headquartered in Cleveland Ohio, and currently operate over 700 branches with more than 700 employees. CrossCountry Mortgage serves all 50 states. They’ve been recognized on the Inc. 5,000 list for their rapid growth and received numerous awards for workplace culture. Clearly, they’re doing something right!

The company offers over 120 mortgage products. Borrowers can apply online, by phone, or in person at a branch. Here’s a breakdown of the service options:

- Conventional and jumbo mortgages

- FHA, VA, and other government-backed loans

- Home Equity Loans

- Bridge loans, construction loans, nonqualified mortgages

- Down payment assistance programs: Up to $6,500 for first-time buyers

- Specialty loans for unique borrower needs

With their emphasis on a variety of services, CrossCountry Mortgage is uniquely positioned to help with a wide array of customer needs. As with any business, Cross Country Mortgage is not perfect. Let’s take a gander at their strengths and weaknesses as a mortgage lender.

Pros and Cons

CrossCountry Mortgage has carved out a niche in mortgage lending, focusing on efficient results and versatile options. With this naturally comes a set of strengths and weaknesses. Let’s break them down:

The Pros

- Wide variety of mortgage products and specialty loan options

- Availability in all 50 states, including D.C. and Puerto Rico

- Fast pre-approval in as little as 24 hours, along with quick closing options

- Down payment assistance for first-time buyers

- Accepts non-traditional credit on some loans

- User-intuitive digital tools and a borrower portal

The Cons

- No mortgage rates posted online, must contact for quotes

- Rates and fees can be above average

- Negative reviews on customer service and communication

- High volume of complaints regarding escrow and servicing

- Transparency issues with loan terms and closing costs

Ratings, Reviews, and Comments

Looking at reviews and ratings should always be an important part of the research process, that’s why we are looking across three major platforms for rating and reviewing businesses. The platforms are the BBB (Better Business Bureau), Google Reviews, and Yelp. We’ll be able to get useful data from this user feedback.

BBB– 1/5

According to the Better Business Borough, CrossCountry Mortgage has hundreds of complaints. The complaints are mostly about escrow, customer service, and billing errors.

Google Reviews– inconclusive

Branches typically average between 2 and 3 stars. Reviews cite fast closing and major communication errors

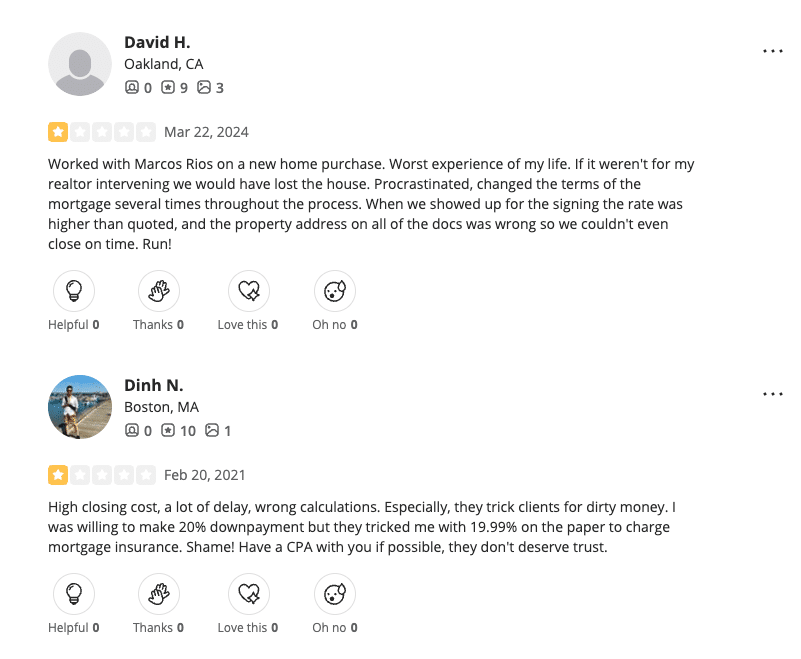

Yelp– 2/5

Negative reviews focus on delays, poor communication, and loan servicing problems

It is worth noting that many review platforms for lenders of all kinds are rife with troll reviews. There are also a lot of people who don’t adhere to their contracts or are not financially literate and make mistakes in the lending process. These people are prone to “lash out” by leaving bad reviews. When comparing reviews of various lenders, you’ll notice the vast majority have lower user reviews for these reasons.

Comparison to Competitors

In comparison with direct competitors such as Rocket Mortgage, Movement Mortgage, and Fairway Independent, CrossCountry Mortgage stands out in several key ways.

First of all, CrossCountry Mortgage offers far more products than most other lenders on the market. This allows customers to find the exact loan product that meets their needs. This is a clear advantage in their favor for customers who know exactly what they want.

With faster closing than competitors, they are ideal for borrowers who want to expedite the lending process. There are also several down payment programs.

How to apply

CrossCountry Mortgage has a very straightforward and user-friendly application process. You’ll find that it is intuitive, and as long as you have the right documentation, it will most likely be without hiccups. Here is the step-by-step breakdown:

- Pre-Qualification

This is an initial assessment of your financial situation to estimate how much you can borrow. To start, complete a brief online form or speak with a loan officer. You’ll provide basic information about your income, assets, debts, and employment. You will then receive an estimate of your borrowing power and can discuss loan options. This step involves a soft credit check and does not impact your credit score.

- Gather Required Documentation

Before applying, collect these documents:

- Photo ID (driver’s license or state ID)

- Two most recent pay stubs

- Two most recent and complete bank statements

- Two most recent tax returns and W-2s

- Proof of assets (retirement, investment accounts)

- Additional documents if self-employed or with special circumstances (e.g., divorce decree, rental agreements).

- Formal Application

Submit a full mortgage application online, by phone, or at a branch. You’ll need to share your personal info, property details (if you have a property in mind), employment and income details, assets, liabilities, and financial history. At this stage, CrossCountry Mortgage will conduct a hard credit inquiry, which may slightly affect your credit score.

- Processing

At this stage, a loan processor reviews your application and documentation for completeness and accuracy. The processor may request more documents, verify employment, order an appraisal, and open escrow.

- Underwriting

An underwriter examines your file, verifies all information, and assesses risk. You may be asked for more documentation or clarification before final approval.

- Appraisal & Rate Lock

CrossCountry Mortgage will order a property appraisal to confirm the market value. You can lock in your interest rate once you have a ratified contract and settlement date.

- Loan Disclosures

Within three days, you’ll receive official loan disclosures and estimates, which must be reviewed and signed.

- Initial Closing Disclosure

This is provided at least three business days before closing, and involves reviewing and acknowledging the loan to proceed to closing.

- Final Approval & Closing

Once all conditions are met, you receive a final closing disclosure. Attend closing (typically at a title company), sign documents, pay closing costs, and receive your keys.

- Post-Closing

Set up your online account to manage payments, view your balance, and access loan information

Is Cross Country Mortgage The Right Choice For You?

In determining if CrossCountry Mortgage is the right choice for your borrowing needs, we must weigh several key factors, the main one being, what do you value in a lending service? If you value optionality and efficiency, then they may be just what the doctor ordered. For those that want a hyper specialized loan option, and want to close ASAP, CrossCountry Mortgage will be a godsend for you.

Now with that being said, there are plenty of reasons that CrossCountry Mortgage would not be an ideal choice for you. Because consistent complaints of CrossCountry loans include customer service issues, loan servicing, and lack of transparency, there are definitely reasons to look elsewhere.

If you are very careful about your loan terms, and are aware of the perceived weaknesses of CrossCountry Mortgage, you are setting yourself up for a harmonious business transaction with them, while taking advantage of their strengths as a lender.

Final thoughts

Taking out a Mortgage is a huge step in life. It involves lots of work, time, and dedication, not to mention the massive amount of money involved in acquiring your dream home. For these reasons, Thorough and in-depth research is an absolute must when in the mortgage market.

This includes researching as many options as possible and reading customer reviews to compare your options. Additionally, complete knowledge of your own financial situation is imperative.

As long as you do your due diligence with research, you will be setting yourself up for complete success in buying a home! So take the guesswork out of getting a mortgage. Explore all angles possible, using articles such as this one or others on Enquirer, and get your home with no roadblocks in the lending process. Happy hunting!

FAQ

- What is the difference between pre-qualification and pre-approval?

Pre-qualification is an initial assessment of how much you might be able to borrow, based on basic financial information you provide. It does not guarantee loan approval.

Pre-approval is a more thorough process where you submit a full application and supporting documents. The lender verifies your credit and finances, and if approved, you receive a pre-approval certificate, which strengthens your offer when shopping for a home.

- What documents do I need to apply for a mortgage with CrossCountry Mortgage?

You’ll typically need:

- Recent pay stubs

- W-2s or tax returns for the past two years

- Bank statements for the past two to three months

- Documentation of debts (student loans, car loans, credit cards, etc.)

- Photo ID

- Additional documents if self-employed, own rental property, or have unique financial circumstances (e.g., divorce decree, bankruptcy papers).

- How long does the mortgage process take from application to closing?

The timeline varies, but the process generally takes 30 to 45 days from application to closing. Factors like how quickly you provide documentation, the complexity of your finances, and the local housing market can affect the timeline.

- What are common reasons a mortgage application might be denied?

Common reasons include:

- High debt-to-income ratio (usually above 43%)

- Insufficient or unstable employment history

- Low credit score or negative credit history

- Inadequate assets for down payment and closing costs

- Issues with the property appraisal or unacceptable collateral.

- Can I refinance my mortgage with CrossCountry Mortgage?

Yes, CrossCountry Mortgage offers various refinance options, including rate-and-term, cash-out, and government-backed refinancing. You’ll need to provide similar documentation as for a new purchase, and the process involves verifying your income, assets, credit, and property value.